[ad_1]

The rules are always in flux and the game can change at the margins, but I’ve been earning free airline tickets for more than two decades now. In some ways, it’s even easier now to get free flights than it was when I started.

Around a year ago, before we had vaccines in arms, I was advising everyone to be banking airline miles and hotel loyalty points while they were not traveling so they could use them later when they were. After all, these points are currency, worth real money in your personal bank. And much easier to keep track of than digital currency coins.

I’ve been following my own advice and have banked enough frequent flier miles on each of the three major alliances that I’ve got enough to fly round-trip to Europe, Asia, and South America next year when borders are open all over (hopefully) and we’re past 70% on the fully jabbed scale.

People have written whole books on this subject of travel hacking, there are at least 100 blogs that cover this subject only, and a whole range of Facebook groups and online message boards about the practice. If you spend a lot of time with these insiders, after a while it starts feeling like a graduate science course, with its own jargon, obscure acronyms, and clubby secrets.

For years though, I’ve had a popular post on this blog that gets newbies started with a travel hacking 101 strategy for earning free travel. If you just follow that, you’ll be ahead of 95% of people without making earning miles and points a second job.

Each year, magazines and blogs crunch the numbers and tell you which loyalty program is “the best,” but in reality, your mileage will vary. If you live in Atlanta, you’re probably going to fly most on Delta, even if United’s program may be more attractive. American Airlines did the worst job of any airline during the pandemic, but if you live in Dallas, you’re going to be flying them a lot most likely. If you’re a business traveler who is on the road twice a week, “the best” program for you is going to be very different than for someone who lives in a strong Southwest market and only flies twice per year.

Your own situation is also going to impact which credit card will work the best for banking miles and which one will give you the fastest payoff. It matters a lot where you live, but what you plan to do with those miles makes a big difference too. If you’re planning to fly to the bottom of South America, for instance, you don’t want to bank American miles. You’re better off with Delta’s alliance or United’s for the partner options. For the Caribbean though, AA might be a better choice. Do a little research and think about your dream trip before you get that next sign-up bonus and move your bill-paying to that card.

Here are the strategies to keep in mind for getting the equivalent of a free flight or two in your mileage account for when you’re able to take off on a trip near or far.

How Many Points Do I Need for Free Airline Tickets?

Most airlines post some kind of mileage chart telling you how many frequent flier milest you’re going to need to earn a free airline ticket between one poin and another. Naturally, domestic travel tickets cost the least, while ones to the other side of the planet are going to cost you much more. Some airlines, like Southwest, base the mileage price on the actual ticket price, so you won’t know how many points you actually need until you do an exact search for the day you want to travel.

Unfortunately, even the ones that don’t do it this way are getting sneakier and less transparent about how many miles you actually need to get to where you’re going. Here’s what’s on the United site now: “We are no longer publishing an award chart listing the set amount of miles needed for award travel on United or United Express flights.” As one post that guesses on mileage levels points out, “United Airlines doesn’t publish award charts. That means the price can be anything United wants it to be.”

Fortunately, this article and others like it have researched actual point redemptions. Plus United’s partners are more transparent, so you can often get an idea on international levels by looking at Copa’s mileage calculator for the Americas and their Asian partners for Asia. Going by those, assume you’ll need around 20K for domestic round trips and here’s what you’ll need for international flights:

Mexico – 30K to 39K

Central America and northern South America – 30K to 39K

Southern South America – 44K to 60K

Europe – 60K to 70K

Asia – 77K to 88K

Australia and New Zealand – 88K+

The good news on the ones that are hiding their info with “dynamic pricing” is that sometimes this can work in your favor. When nobody is flying, as was the case during months of the pandemic, you can pick up an award ticket for much cheaper than usual because they have so many empty seats. I went one-way in business class on American for just 17,500 miles–what it usually costs in the back of the plane. There were tales of people getting a cross-country U.S. flight for just 5,000 miles. The downside is, when demand goes up, United is free to gouge you instead, like Uber’s “surge pricing.”

Delta has stopped publishing an award chart too and if you search a term like that on their site, you’ll see “no results.” You’re flying blind until you search your actual route, with no idea how many miles you’ll actually need. Here’s a rough estimate though of economy class flights, based on what other members have experienced and what I’ve found in my searches. Add 50% to 100% for a business class option, though as long as business travel is suppressed, you’ll find good temporary deals on those.

USA domestic: 15K to 25K miles

USA to Caribbean and Mexico: 17K to 35K

To South America: 25K to 45K

To Europe: 35K to 60K

To Africa: 35K to 60K

To Asia/South Pacific: 45K to 80K

The wide range on some of those is according to not just where you’re headed, but how far ahead you book. Delta actually penalizes you on some routes if you book less than 21 days ahead. So it can pay to plan a month out or more when it comes to mileage redemptions.

Unfortunately, you’ll often pay more miles to fly on Delta’s partners than you will to fly in their planes with your Delta miles, especially in business class, which is really annoying since the partners usually offer a superior experience.

Free Flight Mileage Building Strategies:

As mentioned earlier, it’s good to have a purpose in mind when you’re building up miles. While airline points are a real currency, more often than not it’s one that declines in value more often than it goes up. A depreciating asset, thanks to ever-changing airline policies that are seldom in the consumer’s favor. It doesn’t really pay to hold onto airline points for years on end. Build up to a goal, cash them in, then repeat.

1) Try to concentrate your flying with just a couple airlines or programs.

Southwest is the only airline I fly that I feel has consistently earned my loyalty through good service and generous baggage policies. So I try to fly them in the USA when they are an option. Otherwise, I have mixed feelings about this advice. In theory, concentrating your spending with one or two airlines means you’ve got more of a chance of getting to elite status and getting some perks. In reality though, the airlines make that harder and harder to achieve each year, so most non-business travelers will never get there. I’ve only managed it twice, and I’m a travel writer!

If you have a real chance of getting to elite level though, this can mean a chance at space-available upgrades to business class. Plus if you’re saving for free flights on a specific airline, obviously it makes sense to fly with them to add to your balance. Even if it means you pay a little more sometimes or go through a hub instead of direct, this keeps you from having lots of orphan miles you can’t do anything with.

If you can’t be loyal or think you’re going to be traveling on different airlines all the time, it can make sense to get a Chase Sapphire card or an American Express card (see below) because they both have programs allowing points transfers to multiple companies. That’s great for “topping off” your balance to get to an award level.

2) Get free airline tickets fast through sign-up bonuses

Nearly any airline credit card you sign up for will pay out a bonus you receive after an initial bout of spending. That spending requirement is generally $1,000 to $3,000 within 90 days, so check the terms and make sure you sign up when you’re going to be laying out some money.

Then you get a planeload of points. The legacy carriers and Southwest pay out enough for a couple of domestic flights or at least one international one when you cash in, plus the legacy ones usually offer some kind of extra perk, like a free checked bag on domestic flights. As I right this, United and Delta are both offering 70,000 miles for signing up with the right credit card, enough to fly you almost anywhere in the world if you plan ahead. Southwest is offering 40,000–enough to get you to any of their international destinations.

See the current deals here for how much you could earn now:

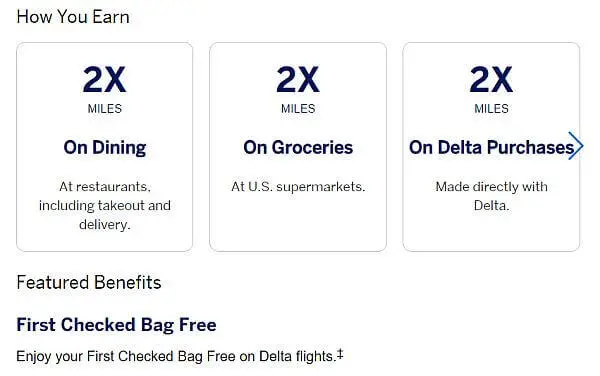

Delta SkyMiles Amex

United Chase Mastercard

Southwest Chase Mastercard

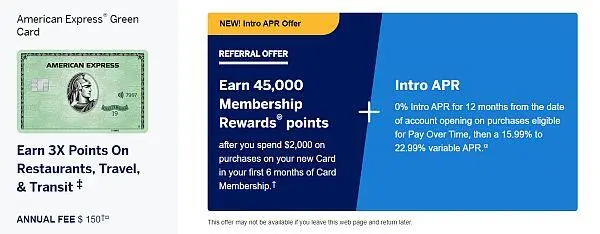

American Express Green Card (transfer points to multiple programs)

2) Pay as many bills as possible through your mileage-earning credit card.

This is not good advice for those who don’t pay off their balance regularly, so be careful. Try to only do this with a card that will get paid off regularly. But if you have the discipline, those recurring internet, wireless, and Netflix bills can really rack up the miles.

Add in some big expenses like tuition or car payments and it doesn’t take long to get to a free flight. Set them up on auto-pay and then pay the card from your checking account.

3) Do all your shopping with a card that earns you mileage.

How much do you spend each year just on Amazon and dining out (or ordering in)? How much do you lay out each Christmas season on gifts? You could likely be earning another few thousand miles.

Pay attention to the e-mails you get about your mileage credit card because you can often double or triple your earnings by using the right card for the right merchant. Many will pay double miles on groceries, gas stations, office stores, or other targeted places. That makes filling up the gas tank a lot easier to bear.

Naturally, the biggest bonuses come from the airlines themselves. Be sure to buy a United flight with a United card, for example, if you have that option in your wallet. Also use it for in-flight purchases when applicable.

4) Shop through the airline site mall.

If you do some shopping through your airline’s merchandise mall, you can frequently earn 3, 5, or even 10 miles per dollar—on top of what you’re already earning from your credit card. You will pay the same price for those flowers or office supplies, but again this can add up quickly.

While a few of them include Amazon in their options, most don’t, so you may want to check the mileage mall first before ordering that new laptop, ink cartridge, or sun hat.

5) Watch for promotions.

Once you’ve aligned yourself with certain airlines, sign up for their e-mail newsletter and keep an eye on promotions. They’re constantly offering double miles on certain routes, mileage-building challenges, and other ways to build up your balance more quickly.

Sometimes they’ll run bonus programs with Uber and Lyft too, so it can be worth switching the card you have tied into those programs to enhance your earnings each time you take a ride.

6) Join and use the dining programs.

The airlines (and many hotel programs) take part in a dining rewards scheme where when you dine at a certain restaurant, you earn 3, 5, or more points per dollar on top of what you’re already earning by charging the meal to the right credit card. Some of these places are even brewpubs or bars, so you can run up a tab and get rewarded for your debauchery.

The programs all go under different names, but they’re really run by a single company, so it’s the same list of dining outlets for all of them. I think I earned 2,000 to 3,000 points a year this way when I lived in Tampa Bay, half of it at places that I could walk to.

A Few Tricks I’ve Learned About Airline Travel Hacking

Like I said, there are more than 100 blogs out there that focus on how to squeeze out a few extra miles and if you want to get to that level of obsession, start at the Boarding Area site or The Points Guy and branch out from there. I’ll admit I don’t check in on those very often, but I do scroll around when I’m in the market for a new credit card and want to see who’s offering the fattest sign-up bonus.

They’re also good for getting a handle on the bad news every time an airline devalues their points and screws over their customers. You can figure out whether it’s worth it to stay loyal to that airline or if you should shift your allegiance elsewhere. Or just be agnostic and go for the best flight deal–that’s been my approach the last few years as it has become harder and harder to earn miles by actually flying. It’s much easier to earn them by the methods outlined above.

A few tricks the experts know that most others don’t:

– Get rid of a credit card if you won’t be using it anymore, especially if there’s an annual fee. If you’re not earning back in benefits more than you’re paying for the card, ditch it. There’s no rule saying you have to keep a card active after the first year. Cancel and replace it with something else to get another bonus.

– Open and read the airline’s e-mails. While they look like junk, the airline e-mails often contain those promotions and deals I mentioned earlier. They’re handing you ways to game their system! Also, miles can expire after a while and you don’t want that to happen. They’ll let you know when you need to take action to retain them.

– Have at least two airline cards. You don’t want to be caught flat-footed if your favored airline changes its policies and your miles suddenly aren’t worth as much. It’s better to hedge your bets. At the very least, have a multi-company card from Amex or Chase that lets you transfer miles to more than one airline.

– View every spending opportunity as an earning opportunity. While I wouldn’t go so far as to put every cup of coffee on a mileage-earning credit card, some people do and it can add up over time. What I do try to do is make sure every recurring bill is earning me miles or hotel points and every sizable expenditure is put on a mileage-earning card. While your debit card is useful for personal finance reasons, it’s not going to help your travel points bank. Use the card whenever you’re not going to pay extra for doing that–or even sometimes when it will cost you extra (like paying your taxes online) if you’re almost to your goal for a free flight and that last expenditure will get you on a flight to Bangkok.

How about you? Have any tips to share that have helped earn you free airline tickets?

[ad_2]